How Estate Planning Attorney can Save You Time, Stress, and Money.

How Estate Planning Attorney can Save You Time, Stress, and Money.

Blog Article

Some Known Questions About Estate Planning Attorney.

Table of ContentsNot known Incorrect Statements About Estate Planning Attorney The 20-Second Trick For Estate Planning AttorneyHow Estate Planning Attorney can Save You Time, Stress, and Money.Getting My Estate Planning Attorney To Work

Your lawyer will certainly additionally help you make your files authorities, scheduling witnesses and notary public signatures as needed, so you do not need to fret concerning trying to do that final step on your very own - Estate Planning Attorney. Last, yet not least, there is valuable satisfaction in developing a relationship with an estate planning attorney that can be there for you later onJust put, estate planning lawyers provide worth in lots of methods, far beyond just supplying you with printed wills, depends on, or other estate planning records. If you have concerns about the process and desire to find out more, contact our workplace today.

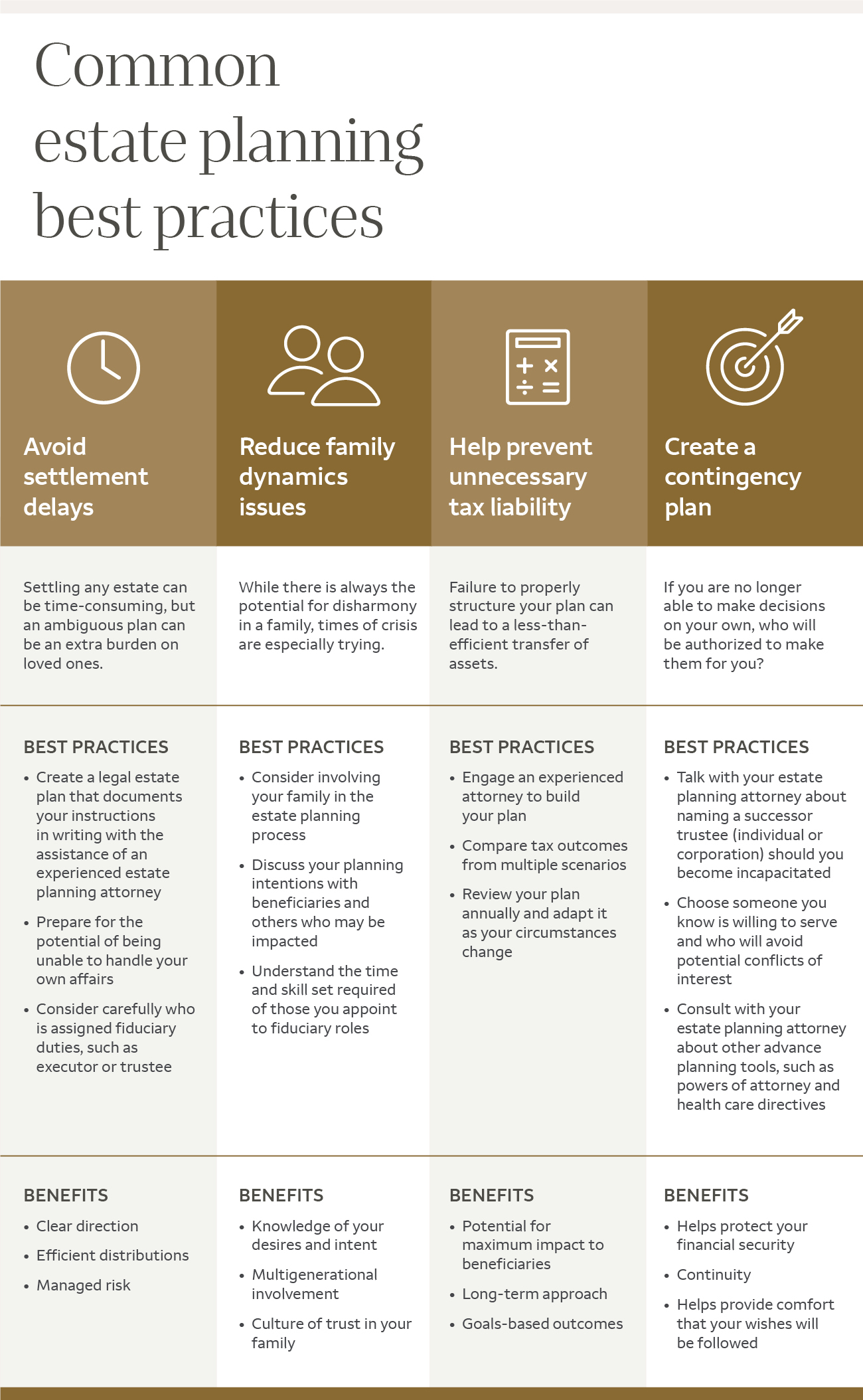

An estate planning lawyer assists you formalize end-of-life choices and legal documents. They can establish up wills, develop counts on, develop healthcare instructions, develop power of attorney, create sequence plans, and more, according to your dreams. Working with an estate preparation attorney to finish and supervise this lawful documents can aid you in the complying with eight areas: Estate planning attorneys are specialists in your state's depend on, probate, and tax legislations.

If you do not have a will, the state can decide exactly how to separate your properties among your heirs, which may not be according to your desires. An estate preparation attorney can help organize all your legal records and disperse your assets as you want, possibly avoiding probate.

The 4-Minute Rule for Estate Planning Attorney

When a customer dies, an estate strategy would dictate the dispersal of assets per the deceased's directions. Estate Planning Attorney. Without an estate plan, these choices might be entrusted to the near relative or the state. Tasks of estate organizers consist of: Producing a last will and testament Establishing trust accounts Naming an executor and power of lawyers Determining all recipients Naming a guardian for minor children Paying all debts and minimizing all tax obligations and lawful charges Crafting directions for passing your values Establishing choices for funeral plans Completing instructions for treatment if you come to be sick and are unable to choose Getting life insurance policy, impairment income insurance policy, and lasting care insurance policy An excellent estate plan should be upgraded on a regular basis as clients' economic circumstances, personal inspirations, and federal and state regulations all develop

As with any kind of occupation, there are characteristics and abilities that can assist you accomplish additional hints these goals as you collaborate with your clients in an estate organizer function. An estate preparation profession can be right for you if you have the following qualities: Being an estate planner indicates assuming in the long-term.

Some Known Incorrect Statements About Estate Planning Attorney

You must help your client expect his/her end of life and what will certainly take place postmortem, while at the very same time not house on somber thoughts or feelings. Some clients may become bitter or anxious when contemplating fatality and it can be up to you to assist them with it.

In case of death, you may be anticipated to have countless discussions and ventures with making it through family members about the estate strategy. In order to succeed as an estate coordinator, you may require to stroll a fine read line of being a shoulder to lean on and the individual counted on to connect estate preparation issues in a prompt and expert manner.

tax code transformed hundreds of times in the ten years in between 2001 and 2012. Expect that it has been modified better ever since. Depending on your customer's economic earnings brace, which may progress towards end-of-life, you as an estate planner will need to maintain your client's possessions in complete legal compliance with any kind of local, government, or international tax obligation laws.

Some Ideas on Estate Planning Attorney You Should Know

Gaining this certification from companies like the National Institute of Certified Estate Planners, Inc. can be a solid differentiator. Belonging to these professional teams can validate your abilities, making you a lot more attractive in the eyes of a prospective client. Along with the psychological benefit helpful customers with end-of-life planning, estate organizers take pleasure in the advantages of a stable earnings.

Estate preparation is a smart point to do no matter of your current health and monetary condition. Nonetheless, not many people know where to begin the process. The initial important thing is to employ an estate preparation attorney to help you with it. The complying with are five advantages of collaborating with an estate preparation lawyer.

The portion of individuals who do not recognize just how to obtain a will has raised from 4% to 7.6% given that 2017. navigate to this website An experienced lawyer knows what info to include in the will, including your beneficiaries and special factors to consider. A will certainly shields your family from loss due to immaturity or disqualification. It also provides the swiftest and most efficient method to move your possessions to your beneficiaries.

Report this page